Renting is like the trial run before home ownership.

You learn how to manage bills, look after a place and figure out what you like. But if you’re starting to think about buying, it’s time to take things up a notch.

Buying your first home doesn’t have to be scary.

With the right know-how, a bit of patience and some smart planning, you can make the leap from renter to owner with confidence and control.

Buying a home usually means getting a mortgage and officially becoming responsible for things like council rates, repairs and maintenance.

Gone are the days of texting your landlord when the tap leaks.

But the upside? Every repayment helps you build equity (that’s your share of the property’s value), which puts you in a stronger financial position long term.

Plus, you can paint the walls whatever colour you want.

Before buying, it’s time for a bit of a financial deep dive.

That means understanding:

A strong credit score can be your golden ticket to a better home loan deal.

If your score could use a little (or big) boost, there are many smart tools out there to help while you’re still renting. And we've got one for you.

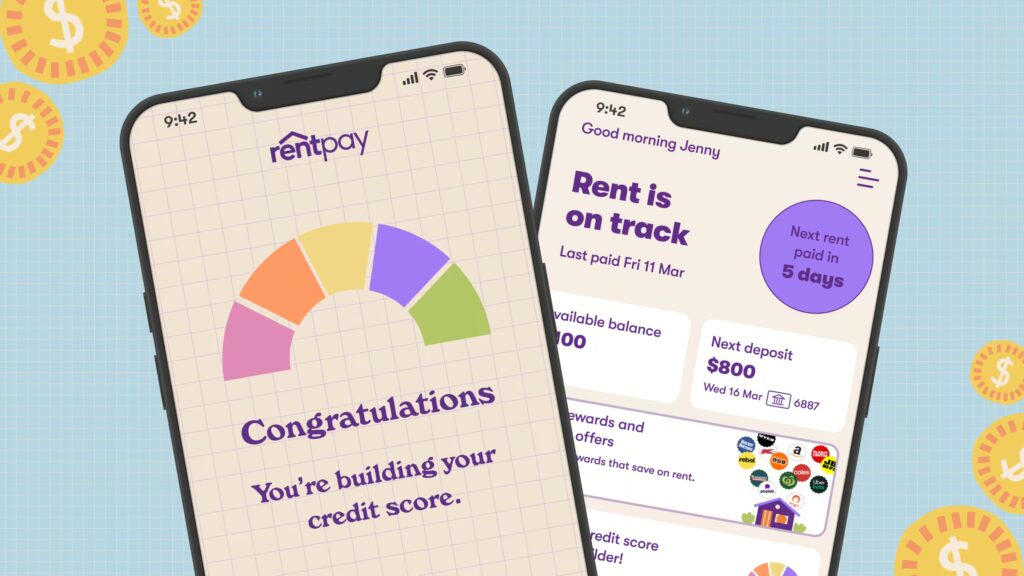

Here's where Scorebuilder comes in.

It’s a handy feature in the RentPay app that gives you access to a line of credit you can dip into when you need a safety net.

Even if you don’t use the funds, just having the account helps build your credit! Your status is reported monthly to one of Australia’s leading credit bureaus.

It’s easy to opt in and if you use the credit, your repayments are manageable and spaced out over four fortnights (similar to Afterpay or PayPal).

Best part? Once you’ve paid it back, you still have access to your limit...

...without needing to reapply.

This access can give you peace of mind while you save for your deposit.

To buy, you’ll need a deposit, which is generally at least 5 to 10% of the property price. The bigger your deposit, the better your loan options.

If you hit 20%, you can usually skip lenders mortgage insurance altogether (which can save thousands), but it’s worth researching the pros and cons.

Establish a clear savings goal, build a realistic budget and consider setting up automatic transfers into a dedicated savings account to stay on track.

It’s not the most exciting part, but it gets you one step closer to a home.

Spoiler alert: buying a home involves more than just the deposit.

Here’s what else you’ll need to factor in:

It’s a lot, but knowing what to expect means no nasty surprises.

Top tip: The Australian Government’s first home buyer guide explains your options, including grants and ways to save for a deposit faster.

Getting pre-approved for a home loan means a lender has looked at your finances and agreed (in principle) to lend you a certain amount.

It gives you a price range and shows sellers you’re serious. You can go directly to a bank or chat with a mortgage broker to look at your loan options.

Once you’ve got pre-approval sorted, the fun begins. Open homes, scrolling listings and dreaming about how you’ll set up the living room.

But make sure to keep a list of must-haves versus nice-to-haves.

Think about things like:

Think about what matters most, what you’re willing to compromise on and remember, it’s totally fine to change your mind as you go.

Before committing to the purchase, make sure you arrange a building and pest inspection. It’s an important step and skipping it could cost you later.

These inspections can uncover issues that aren’t visible during a quick walkthrough, such as structural damage, termites or plumbing problems.

If something concerning comes up, you might be able to renegotiate the price or walk away from the sale, depending on your contract terms.

Think of it as doing your homework before the big move.

Renting isn’t just a stopgap, it can actually support your long-term goals.

Tools like Scorebuilder give you credit for paying your rent on time and help you build a financial profile that looks great to lenders.

You’re not starting from scratch. You’re already on the path.

Buying is just the next chapter.

You might also like:

> Build an emergency fund on a tight budget

> How to get a month ahead of your bills

> Money-saving meal planning and cooking