RentPay is more than a rental payment platform and digital wallet. We’ve intentionally packed in a raft of features which provide Aussie renters with convenience, choice, rewards and financial benefits.

Check out the scenarios we’ve mapped out in this article to find out how savvy RentPay users are reaping maximum savings, rewards and benefits.

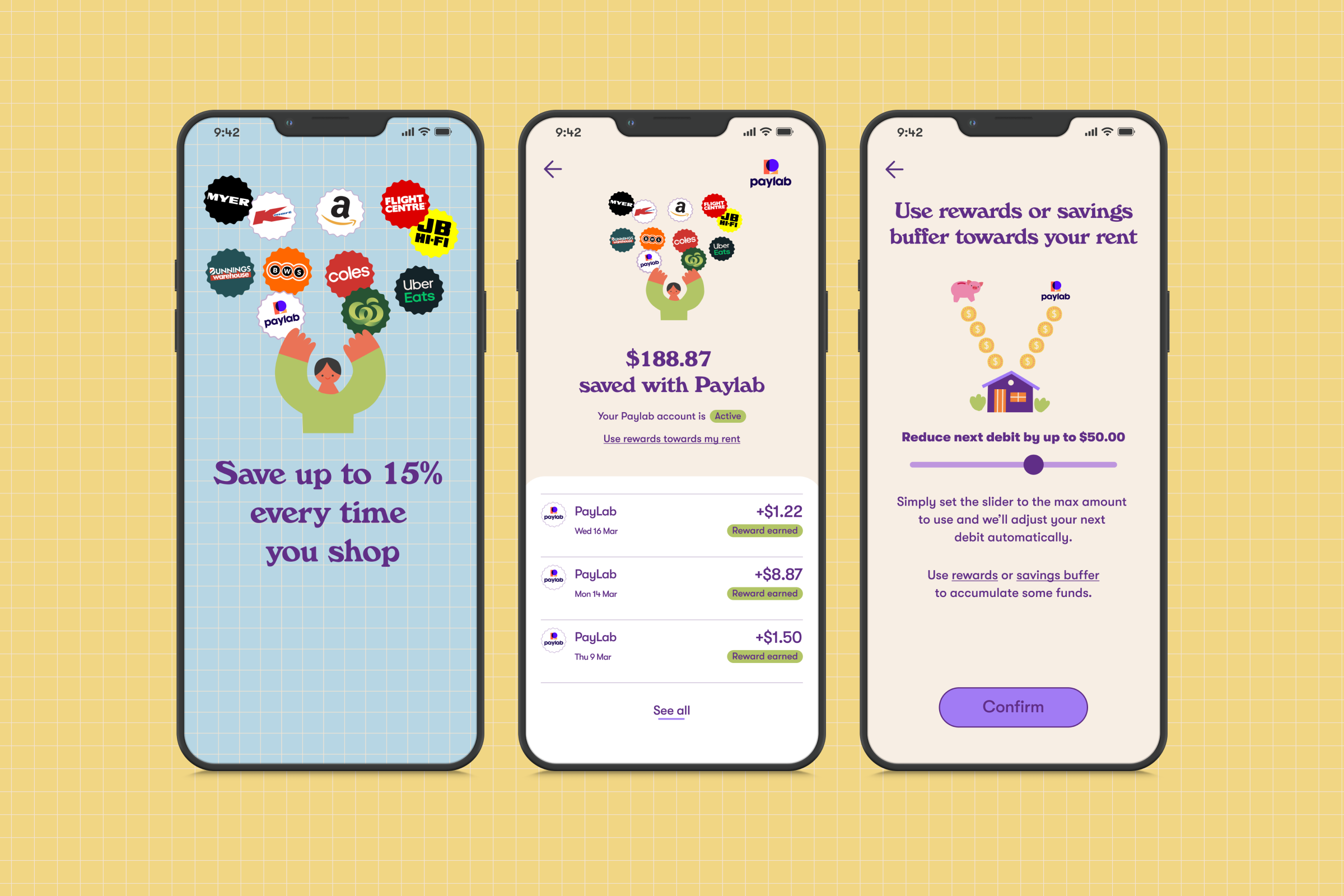

The top features RentPay users access to get the highest dollar value return are:

The following examples show you a few possibilities for how you could take advantage of these features to spend less on the things you already need to pay for, or be rewarded by paying your rent smarter using RentPay.

To help make things clearer on how RentPay can help users make every dollar stretch further, we’ve put together a few examples to show how it could work for you.

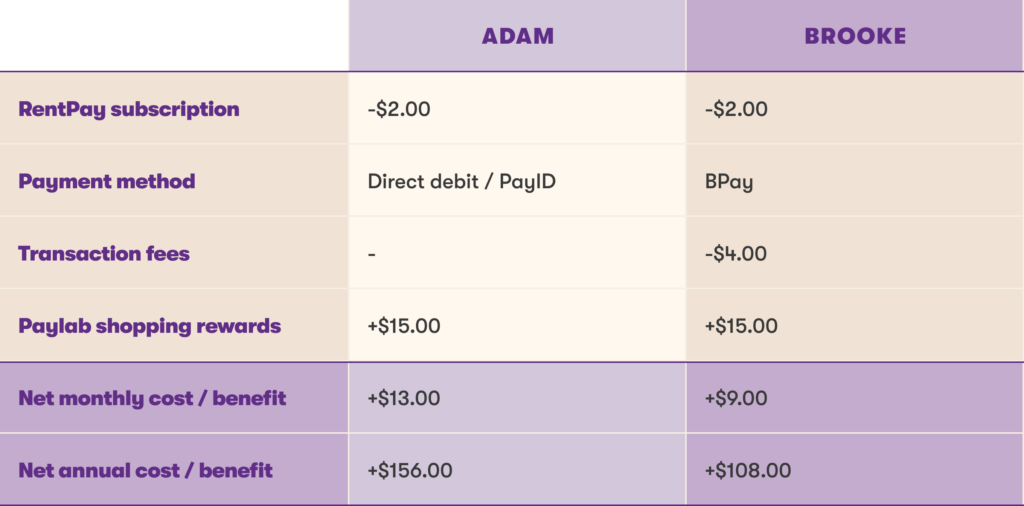

For demonstration purposes, the assumptions we’ve made about the RentPay users’ situation in the following scenarios are based upon:

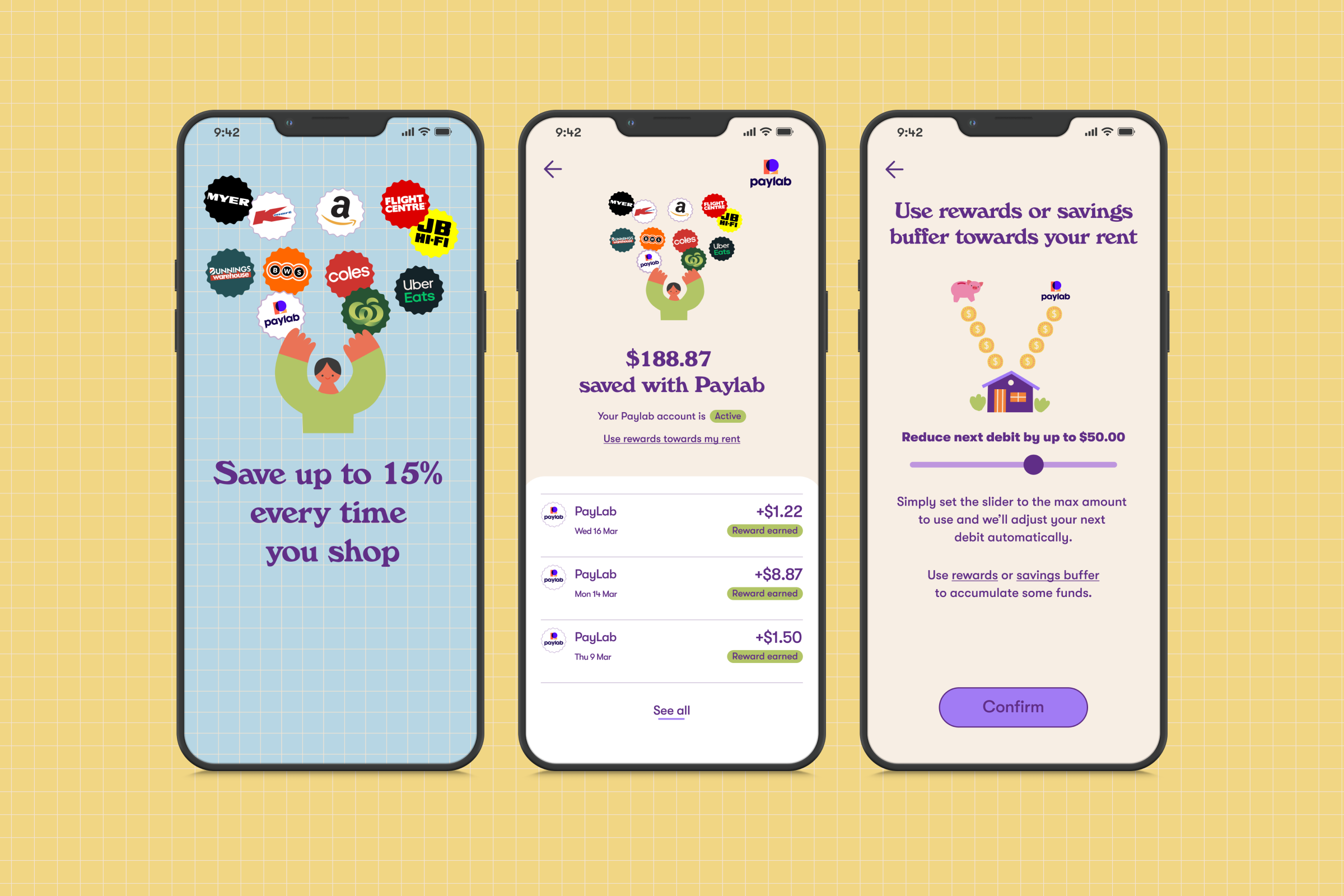

We then calculated net cost/benefit per month using RentPay’s shopping rewards through Paylab feature which help users to save money on purchases, such as grocery supplies (plus other things you don't need, but must have!).

The outcomes of the scenarios (with the previously mentioned assumptions) in the above table are:

As you can see, it doesn’t take much to make using RentPay more rewarding for you.

For a low $2 monthly subscription to use RentPay, you gain access to features and benefits which help you to put more towards your rent and other bills, or into your savings!

*Important notes: Additional charges apply for some payment options. The scenario for RentPay users who've been invited to join via a property manager will vary slightly from these example scenarios (calculations are based on users who joined RentPay directly) due to fees associated with payment methods.

Your own personal situation may somewhat match or be completely different to the above scenarios we’ve outlined. Hopefully, it at least gives you a few ideas on how you can make the most out of your RentPay account.

Tenants using RentPay are actually financially better off—regardless of whether you've joined RentPay directly or have been invited by your property manager—when using RentPay to pay rent and incorporating at least one additional reward feature.

Based on how RentPay users are taking advantage of various features, mixing and matching several features could help you maximise your savings and reach your goals faster.

For more information, visit the RentPay’s frequently asked questions or contact us.

You might also like:

> Pay rent your way: Choosing your preferred payment method

> Point hacking: How to pay rent with a credit card and earn points

> Avoid budget blowouts with RentPay bill smoothing